Our last two posts determined a working definition for “hedge” (Part One) and identified risks a business needs to protect against.

In our previous post (Part Two), we identified three main risks businesses face. We then discussed how those risks appear in the fuel industry. These risks are listed below.

- Margin Erosion – a major risk that all businesses encounter.

- Fixed Price risk – a risk that fuel distributors face when selling a future delivery of a fixed price product or service to customers.

- Market risk – a risk faced by firms dealing with market-based commodities (such as gasoline, diesel, and propane).

Beginning to Hedge

Today we move to the process of actually starting to “hedge” against these risks. One hedging method mentioned in Part Two was to simply NOT sell any future fixed price product or services to your customers. Since this approach typically reduces sales, there’s a clear need for a different hedging process.

A Hedging Example.

Another way to hedge is using an equal and opposite transaction to offset your fixed price and market risks. A basic example of this process is shown below.

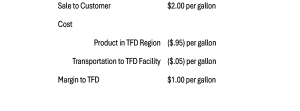

- A fuel distribution company called Twin Feathers Distributors (TFD) sells 1,000 gallons of a future propane delivery to a customer at a price of $2.00 per gallon.

- TFD desires a margin of $1.00 per gallon on this sale.

- The current propane market in the TFD operation region allows for the purchase of future volume at a price of $.95/gallon plus the transportation cost of $.05/gallon to the TFD facility.

- Here is how the math will work:

In this example, TFD has been able to achieve their future margin by “hedging” both their fixed price and market risk with the regional product purchase and transportation to their facility. This achieves the goal and does not allow for margin erosion.

Definition of Important Terms.

Through this process, there are three very important terms that need to be introduced to help with our future hedging discussions. These terms are as follows:

- Short – A financial term that refers to a business selling a commodity that they have not yet purchased. In this situation, the business that is short believes they can make a future commodity purchase at a steady or cheaper price.

In our above example, TFD was short because they first made the customer sale before procuring the product.

- Long – A financial term referring to a business purchasing a commodity at a set price that they intend to sell sometime in the future.

This situation is the opposite of the one above because the business that is long believes they can make a future commodity sale at a steady or higher price.

- Prebuy – A term more common within the propane industry, this refers to a fixed price purchase of propane at a particular terminal within a region.

In the above example, TFD made a prebuy purchase in order to “hedge” their risk.

These three terms, along with our example of using an equal and opposite transaction to offset your fixed price and market risks are just the beginning of the hedging process. In future posts, we will dig deeper into how hedging works, exploring other ways to prevent market erosion.